Most folks pack their Medicare card right next to their passport, thinking it's the golden ticket to any hospital in the world. Here’s the reality: Original Medicare almost never covers medical care outside the U.S. or its territories. That means if you land in a hospital while you’re sipping coffee in Paris or road-tripping in Thailand, flashing your Medicare card won’t get you past the admissions desk.

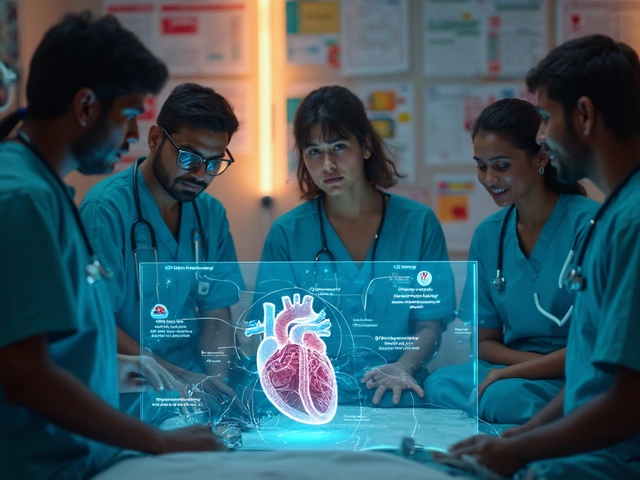

This surprises a lot of travelers. A report from the Centers for Medicare & Medicaid Services spells it out—regular Medicare is mostly useless overseas except in a handful of rare, emergency situations near the border, like if you have a heart attack on a cruise right off the U.S. coast. Even then, the loopholes are tight.

So, tossing your Medicare card in your international travel kit? Honestly, it doesn't do much. Most travel health insurance companies and private hospitals abroad have zero idea how to process one. If you need proof of insurance or identity, your passport (and a travel health insurance policy) will do way more heavy lifting.

- Does Medicare Cover You Overseas?

- Scenarios Where a Medicare Card Might Help

- What Medical Documents Should You Carry Abroad?

- How to Stay Protected While Traveling

- Common Mistakes and Pro Tips

Does Medicare Cover You Overseas?

Let’s get straight to the truth: for 99% of situations, Medicare will not pay for your care outside the U.S. If you’re traveling in Europe, Asia, Africa—anywhere outside the fifty states, D.C., Puerto Rico, Guam, American Samoa, the Northern Mariana Islands, or the U.S. Virgin Islands—your Medicare coverage just stops working.

There are only a few very rare exceptions, and you’ll probably never run into them. Here they are:

- You’re in the U.S. when a medical emergency strikes, but the closest hospital is in a foreign country (think border towns like El Paso, Texas or Detroit, Michigan closer to Canadian hospitals).

- You’re traveling through Canada between Alaska and another state without unreasonable delay, and a medical emergency happens on the Canadian stretch.

- You’re on a cruise ship, but only if the ship is within six hours of a U.S. port and you get treated on board or in the U.S. port.

These circumstances are pretty specific. So don’t count on your Medicare kicking in for that Bali scooter accident or food poisoning in Barcelona—hospitals there will see your card and just shrug. Private hospitals abroad almost never bill directly to Medicare because they have zero agreement with the U.S. government.

Long story short: unless your trip is a weird border-hopping medical disaster, Medicare simply isn’t the kind of coverage that follows you around the globe. Better look into other options if you want real protection overseas.

Scenarios Where a Medicare Card Might Help

Alright, so let’s set the facts straight—your Medicare card is next to useless abroad, but there are a couple of oddball cases where it can actually help out. First, if you’re traveling in the U.S. territories like Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, or the Northern Mariana Islands, you’re still covered. Your Medicare card works there the same way it does back home. You’ll get your benefits, and any hospital familiar with Medicare will know exactly how to process it.

Second, there’s a super-specific rule about coverage right near the U.S. border. For example, if you’re in Canada, and the closest hospital for an emergency happens to be just across the border from the U.S., Medicare may cover you. Same goes for if you’re on a cruise ship but within six hours of a U.S. port. Here’s the catch: the hospital can’t be just any random clinic. It has to be the nearest, and it’s only for emergencies, not routine stuff.

Lastly, sometimes you may need to visit medical facilities at U.S. embassies or military bases. You’ll need your Medicare card for identification, but honestly, the odds of ending up in that scenario are pretty slim if you’re traveling for fun.

To sum up, here are the only times your Medicare card might play a part overseas:

- When you’re in a U.S. territory—Medicare works as usual.

- During emergencies near the U.S. border where a foreign hospital is genuinely the closest (think sudden heart attack on a Canada road trip right by the border).

- Certain emergencies on cruise ships within U.S. waters.

- Needing ID at U.S. government facilities (rare for regular travelers).

If you don’t fit these situations, your card is pretty much dead weight outside the States. Best to carry it only if your trip includes any of these weird scenarios—and don’t count on it to help in places like Europe or Asia.

What Medical Documents Should You Carry Abroad?

When you’re heading overseas, don’t just toss random papers in your bag. Having the right medical documents can save you big time in an emergency – like, skip-the-waiting-room-and-get-help-now big. If you only remember one thing, know this: hospitals and clinics abroad don’t care about your Medicare card. They want documents they can actually use.

Here’s a clear list of what you should pack:

- Travel Health Insurance Card: This is the most important. Whether you bought coverage through your credit card, your airline, or a separate travel insurance policy, have the card or digital copy ready. It proves you’re covered for emergencies and speeds up admission and billing.

- Passport: No brainer, but hospitals use this to verify your identity. Have it handy, not at the bottom of your bag.

- Printed and Digital Copies of Your Policy: Your travel insurance might cover only certain things. Keep a summary of coverage (in plain language, if possible) with emergency contact numbers for the insurance company.

- List of Medications: Include both brand and generic names, dosages, and what they’re for. Makes it easier if you need a refill or the local doctor needs to see what you take.

- Doctor’s Letter (if you have a chronic condition): A short statement about your condition and treatment is good to have, just in case you run into issues or need emergency care.

- COVID-19 or Other Vaccination Certificates: Many countries still want proof for entry or hospital admission, especially for high-risk travelers.

Here’s a quick look at what foreign clinics will ask for versus what’s actually useful:

| Document | Needed for Treatment? | Reason |

|---|---|---|

| Medicare Card | No | Not accepted outside U.S. or its territories |

| Travel Insurance Card | Yes | Accepted globally for billing and claims |

| Passport | Yes | Identity verification |

| List of Medications | Sometimes | Aids in faster pharmacy service |

| Doctor’s Letter | Sometimes | Needed for chronic or rare conditions |

If you’re the forgetful type, snap photos on your phone or scan everything to your email before you fly. Stuck in a foreign hospital? You’ll thank yourself for making these just a few taps away. Trust me, scrolling through your inbox is better than dealing with a language barrier or an uncooperative photocopier when you need care fast.

How to Stay Protected While Traveling

Here’s the deal: if you’re leaving the U.S., do not count on your Medicare card for emergencies. Most foreign clinics and hospitals won’t recognize it. What actually keeps you safe is planning ahead and carrying the right stuff.

Your top priority? Get travel medical insurance. A lot of people skip this, but a single hospital visit overseas can set you back thousands, even for something simple. And if you need a medical evacuation—like an air ambulance ride home—that can cost six figures. Yikes.

- Buy travel health insurance before you leave the U.S. Compare different companies and read what they actually cover; some plans specifically include U.S. seniors.

- Double-check: Does your policy pay providers directly, or do you have to pay upfront and get reimbursed? Knowing this makes a big difference when things go wrong.

- Print your policy details and the insurer’s 24/7 emergency phone number. Losing Wi-Fi at the wrong moment is pretty common abroad.

- Carry a copy of your passport, insurance plan, and a list of any medications or allergies. If something happens, these details help hospitals treat you better and faster.

Curious how much a health surprise could really cost? Here’s a quick table:

| Country | Average ER Visit (USD) | Medical Evacuation to U.S. (USD) |

|---|---|---|

| France | $200 - $600 | $50,000 |

| Thailand | $150 - $500 | $85,000 |

| Mexico | $250 - $850 | $25,000 |

If you have a Medicare Advantage plan (also called Part C), a handful do offer some international emergency coverage—check your plan’s small print. But Original Medicare is still a no-go overseas in ninety-nine percent of cases.

Bottom line: for smart Medicare card holders, travel medical insurance is non-negotiable. It’s what keeps your adventure fun (and your finances safe) when something unexpected pops up while you’re far from home.

Common Mistakes and Pro Tips

People mess up international travel with Medicare more often than you’d think. Stuffing your Medicare card into your wallet and thinking you’re covered is the number one goof. Medicare almost never pays out for care outside the U.S. If you break your leg in Italy and whip out that card, the hospital staff will just shrug.

Another blunder: assuming your U.S. supplemental or Medigap plan works everywhere. A few Medigap policies throw in limited foreign emergency coverage, but there’s usually a lifetime cap (like $50,000), big deductibles, and strict limits. Most Medicare Advantage plans toss international coverage out the window. Always double-check what your plan really offers—don’t just trust what your buddy says.

- Not buying travel health insurance. This one’s huge. According to the U.S. Travel Insurance Association, around 30% of travelers skip proper insurance for overseas trips and end up paying thousands for emergencies.

- Forgetting to bring a list of prescriptions. You’d be surprised how many people show up at foreign clinics without knowing their exact meds or dosages. Carry a printed list with you.

- Not having important local emergency numbers handy. 911 doesn’t work everywhere—you need to know who to call in each country.

- Only bringing English-language medical documents. A translation can save time and hassle, especially in non-English speaking countries.

Here’s how travelers often end up in a bind abroad, according to a World Health Organization report and insurance industry data:

| Common Mistake | Real-World Impact |

|---|---|

| No travel insurance | Average overseas emergency bill: $10,000+ |

| Relying on Medicare card abroad | Zero coverage for hospital stay, high out-of-pocket costs |

| No medication list | Delayed or incorrect treatment |

| Not knowing local emergency numbers | Slower response during critical emergencies |

A few pro tips you’ll wish you knew sooner:

- Always buy solid travel health insurance—it’s pretty cheap compared to the cost of even one ER visit. Bring a copy of your policy and claim instructions.

- Snap pics of your important documents and store them securely online. If your bag gets stolen, you won’t be stuck.

- Download offline maps and local emergency numbers before you go. WiFi isn’t always available when you need help.

- If you’re traveling with a chronic condition, carry a doctor’s note in both English and the local language. It speeds up care and avoids confusion.

Bottom line: The most common mistakes all start with assuming you’ll be fine with just U.S. insurance paperwork. Don’t risk it—get prepared, buy travel health insurance, and know what to do in an emergency. Your wallet and health will thank you.

Rohan Talvani

I am a manufacturing expert with over 15 years of experience in streamlining production processes and enhancing operational efficiency. My work often takes me into the technical nitty-gritty of production, but I have a keen interest in writing about medicine in India—an intersection of tradition and modern practices that captivates me. I strive to incorporate innovative approaches in everything I do, whether in my professional role or as an author. My passion for writing about health topics stems from a strong belief in knowledge sharing and its potential to bring about positive changes.

view all postsWrite a comment